ELECTRONIC TAX REGISTERS

Ksh 19,999.00

Safety Tips

Meet a seller in public place and be sure to pay only after collecting your item.

Additional Info

| Mobile | 0723490545 |

| Street | Moi avenue |

| City | Nairobi |

| State | Nairobi County |

| Country | Kenya |

| Zip/Postal Code | Sonalux House |

Photo Gallery

|

|

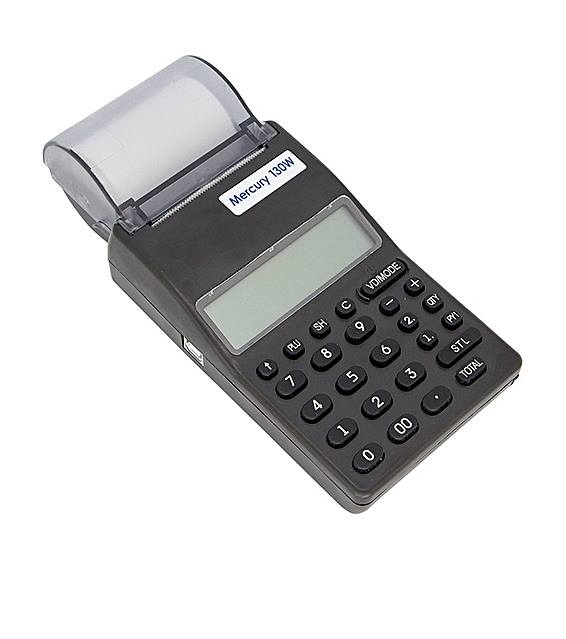

FOR SALE ETR MACHINE / MERCURY 130W /DAISY EXPERT/DP 50 Fiscal Device

Peckerwoods Ltd / ERT Machines have been approved by Kenya Revenue Authority (KRA), as a supplier of Electronic Tax devices.

Kenya (EFD) The tax register machine was introduced in Kenya in 2005.

An Electronic Fiscal Device (EFD) is a machine designed for use in business for efficient management controls in areas of sales analysis and stock control system and which conforms to the requirements specified by the laws.

Peckerwoods Ltd. is approved by Kenyan Revenue Authority has approved ESD as the Electronic Signature Devices (ESD).

An Electronic Signature Devices comprises of two components, a Certified Invoicing System (CIS) and a Sales Data Controller (SDC). Sales Data Controller (SDC) records every transaction received from Certified Invoicing System (CIS), and then ensures that electronic signature on the receipt is printed.

The signature is verifiable by KRA officers using a special decryption tool, which is unique for every installed SDC device; therefore any falsification of the signature can be immediately detected.

Features:

• Connects to a PC via USB.

• Lithium battery to support real time clock.

• Automatic report issuing with 2GB SD card for storage.

• 1.2 Invoices per single SD card

Benefits:

• Can be easily integrated to other software.

• For corporate safe huge billings in telecommunications and electricity

KRA-compliant, portable self-stand cash register Mercury 130W/ACLASS CRBX/DP 50/DAISY EXPERT are designed for money accounting with customers in trade (outdoor trade) and service. It performs operations of bookkeeping and control, prints out receipts, control tape (electronic log) and reports (X-reports, Z-reports, fiscal report by number and dates, report by registrations).

ALL VAT Registered persons are required to install and use ETR Machines for all sales transactions

TAKING SHORT-CUTS IS EXPENSIVE AND RISKY…

Make sure you have the correct ETR DEVICE for your business.

TAXPAYERS

Input Tax claims, Input tax deduction allowed only for purchase supported by ETR generated receipts/Invoices.

So do yourself a favor and take the tax load off your shoulders and buy an ETR Machine….

“

DO NOT TAKE RISKS”

Arrest of sellers for not using ETR receipts,

Sellers liable to fines up to a maximum of 500,000/ or Imprisonment of a term not exceeding 3 years of both

Sellers: “Use ETR to record and issue receipts for all sales done

Buyers: “Demand for ETR receipts for all purchases done

NB:

It is your obligation to issue ETR receipts upon sale or delivery of goods & services.

Failure to issue an ETR receipt by a registered VAT taxpayer is an offense punishable under the VAT Act and any goods in respect of which an offense has been committed are liable to forfeiture.

!

We offer the following product;

Portable Mercury 130W/DAISY EXPERT/ACLASS CRBX/DP 50 for business that issue invoices and cash sales/receipts manually

Condition: Excellent!!

Terms of sale: Cash only

Price: KSH FROM 21000

If interested in buying please call Mobile no 0723490545 / 0713405775

Safety Tips

Meet a seller in public place and be sure to pay only after collecting your item.

- Moi avenue Nairobi Nairobi County Sonalux House